-

Menu

-

Close

Since the inception of the real estate business in the 1970s, Bangladesh has experienced substantial growth over the period. Currently, it is one of the fastest-growing sectors in the country, while having deep impressions from the economic perspective.

The industry kept growing steadily in the initial period through the rapid development of Bangladesh’s infrastructure and housing sector. Increasing demand for better housing, ever-growing middle-class families, and roaring per-capita income was mainly responsible for the tremendous growth the real estate industry has experienced in our country. Even though the growth in this sector was only fueled by the increasing number of apartments, nowadays, condominiums, shopping malls, important infrastructure, commercial buildings, hotels, hospitals, roads, bridges, etc. are contributing immensely to the growth of the real estate industry in Bangladesh.

The government of Bangladesh has taken extensive steps to facilitate private investment opportunities to support the growth of this sector. Experts believe that the real estate industry will continue to grow in the coming years and become a significant contributor to Bangladesh’s journey to becoming a developed nation.

After the liberation war in 1971, Bangladesh slowly started to recover from the immense turbulence it witnessed. It was finally time for expanding its industries and businesses. Even though the real estate industry began to set its footprints in the early 1970s, the industry started to flourish during the 1980s. It was the time when rapid urbanization started to take place. Because of how quickly the population was expanding, finding additional space for more people became essential. Bangladesh is a developing nation, therefore with rising urbanization under its authority, the government was unable to provide homes for everyone. In the past 40 years, the real estate sector has taken on the challenge of housing our large population, and it has not been easy.

In the 1970s, only five companies were operating in the real estate industry, mostly focusing on Dhaka for the development of the housing sector. However, the scenario quickly changed in the following decade as more players ventured into the market due to the surge of demands for lands and houses to accommodate the growing population.

In the 1990s, Bangladesh experienced a major construction boom, due to the emerging necessities for industrial buildings, corporate offices, housing units, roads, bridges, hospitals, shopping malls, and other variants of infrastructure. Bangladesh carried on with this trend to the current day to fuel its necessities. More and more companies started to venture into this market due to its lucrative opportunities. For example, in the early 1990s, around 42 developers were working in Dhaka. The number rose to 800 in early 2013 and as of 2016, the number currently stands at 1151.

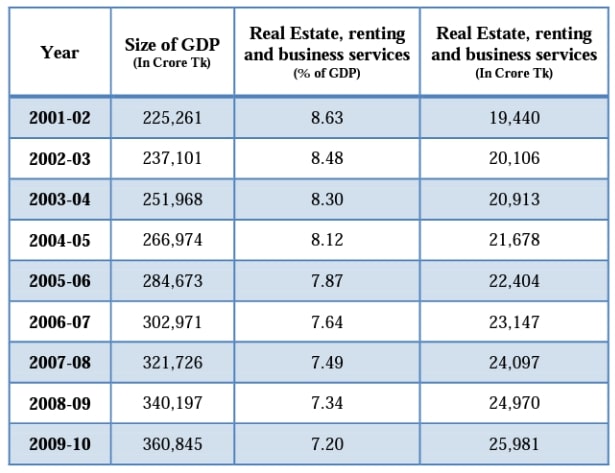

In the first decade of the 21st century, Bangladesh’s economy showed a strong correlation with the GDP of the country, indicating the impact of the real estate industry. As people were gradually able to increase their disposable income, it became quite clear that people in the country were looking for ways to better their living standards. Hence, the demand for more comfortable homes was rising. Also due to heavy investment opportunities from abroad, international corporations required high-standard office spaces with ample amenities. It was also a major driver behind the rising trend for real estate in the country. The following graph shows a strong correlation between the Overall GDP growth and the Real Estate Industry growth in Bangladesh in the 2000s.

As the number of businesses grew steadily, a number of issues relating to the housing sector emerged and needed to be addressed quickly. In order to safeguard the sector’s broad interests at this point, a trade organization of real estate developers was required. In 1991, the Real Estate & Housing Association of Bangladesh (REHAB) was established with just 11 members to enhance the role of the real estate industry. Promoting formal private-sector real estate development in Bangladesh was REHAB’s main goal.

Currently, REHAB has almost 1200 members in the association. REHAB’s contribution to the development of the real estate market in the country has been substantial. It formed an agreement between all the existing members and provided valuable resources and feedback on the development phase the country has experienced over the years. In the form of registration fees, income taxes, and utility service fees, REHAB members significantly increase the government’s revenues.

Source: REHAB

The real estate sector is currently Bangladesh’s one of most attractive investment opportunity. This may be largely attributed to the rate of urbanization that is rising. According to World Bank data, Bangladesh is now urbanizing at a pace of roughly 3% per year. Bangladesh’s urban population now makes up around 38% of the nation’s overall population. In all major urban areas, there is a serious lack of housing that is available, and as the demand for new dwellings develops, this shortage is predicted to get worse.

Between 6 and 8 lakh units are thought to be currently needed in the nation’s largest cities. The lion’s share of real estate development is concentrated in Dhaka and Chattogram because these cities have the majority of Bangladesh’s urban residents. According to estimates, Dhaka alone needs 60 thousand flats, in addition to the 2 lakhs of replacement units and project delays. Dhaka has been growing faster than any other city in Bangladesh in recent years. As a result, there is a considerable demand for plots and apartment buildings. Due to its scale and enormous unmet demand, this industry appeals to both international and local investors.

People are also leaning toward residential areas currently in Dhaka. They want a place that is far away from the cacophonous sounds of city vehicles. Despite the increased price, the intention of people to invest in apartments close to nature is an observable trend. There are several upcoming commercial projects in Dhaka, waiting to be disclosed to the public as well.

Among all other places in Bangladesh, Dhaka is witnessing remarkable growth in the real estate industry. At its present rate of growth, Dhaka can accommodate more than 600,000 people annually. This implies that the additional population in this metropolis will demand more than 120,000 housing units. Currently, there are only around 25,000 housing units available in the city, of which 15,000 are given by private sector donors such (as real estate development companies). Parents and one or two children make up the majority of families nowadays, and they prefer to live in flats with two or three rooms. The majority of the units are between 1,000 and 1,600 square feet in size. The real estate industry hasn’t fully been able to solve the problem of low-income housing since just 2% of residential flats are less than 700 square feet. But more people are getting interested in purchasing small apartments, as the number of nuclear families is increasing. However, people prefer having at least a three-bedroom apartment.

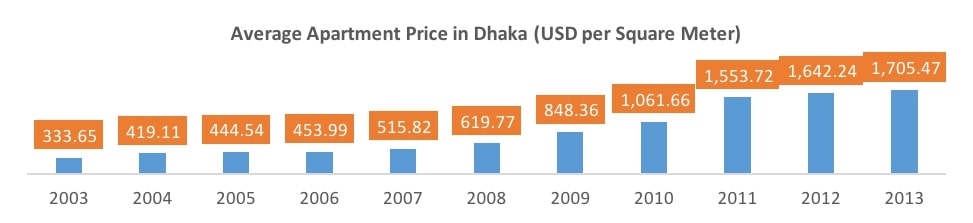

Source: IDLC

Since people did not make such significant expenditures during the Covid-19 pandemic, there was little demand for apartments when the government imposed a two-month countrywide lockdown between March 26 and May 30, 2020. All house developments were stopped as a result. Around 6,000 REHAB member projects had to be placed on hold due to the lockdown since staff members, including construction workers, had to go home. Due to the lack of funding and the fact that several customers were unable to pay their payments on time, housing business owners were particularly anxious regarding how they would compensate their employees.

The real estate market rebounded after the Covid-19 disaster because untaxed income could be used to buy homes, land, and apartments without needing to be included in the current fiscal year’s budget. According to those in the know, low-interest mortgage loans are being offered by banks and NBFIs as a secured investment for the lenders at rates below 9%. Dhaka’s real estate market opened up, making it easier for more people to buy homes there. Since the lockout has already delayed real estate developments by a year, investors are paying greater attention to ongoing projects. Ongoing flats for sale are becoming more and more available for sale each day after the lockdowns were lifted and people started to enter into their normal lives again. It helped to rotate the wheel of the economy in the country.

A new trend emerged in the Bangladeshi real estate industry as the pandemic situation began to ease down. People were very interested to purchase apartments in Dhaka. As a result, the demand for flats increased in the city as more and more people were interested in purchasing their new abode. Medium-sized flats were high in demand and the prices were competitive in this range as well.

After the Covid-19 pandemic, the real estate industry experienced a new trend. A new customer base emerged where people were looking into studio apartments. These apartments are usually single spacious rooms ranging from 250 sqft to 1000 sqft, including a bedroom, dining room, a relatively small kitchen, and toilets. People are also getting interested in luxury commercial properties, using them for various business purposes.

Contrary to conventional buildings, steel structure buildings are gaining amazing popularity in city areas. It is much safer and very quick to build. Furthermore, steel structure buildings can withstand natural calamities such as earthquakes or strong winds much better than other types of buildings.

Many real estate development companies have adopted a fully digitized version of the service module where customers can easily check all of the features provided by a certain company. These companies showcase an extensive website where people can view their portfolio, ready flats in Dhaka or other parts of the country, and flats under construction. The virtual presence has helped a lot of prospective buyers to make informed decisions about their investments.

The sales rate in Mumbai, New York, Berlin, Dubai, Istanbul, Rome, Paris, and other large, real estate-friendly cities has plummeted by 30% to 60%, according to a review of the real estate markets of these cities during the last year. In contrast to that, the sales rate in Dhaka has dropped by barely 20% compared to the usual period. The issue that now emerges is why real estate sales have increased during this epidemic and why Dhaka’s real estate market is functioning better than that of other cities across the globe. Furthermore, some of the best residential places are in Dhaka.

Compared to neighboring countries, people in Bangladesh feel much safer investing in real estate, instead of other investment opportunities such as bonds, stock markets, SMEs, or mutual funds. It also provides an extremely secure future for yourself and your family. It is why investing in real estate is the best option in Bangladesh.

The total worth of Bangladesh’s real estate market is estimated at 58,000 Crore BDT with an annual growth rate of 15 – 17%. There has been a growth of 39% in the last five years in the supply of 1200 –1400 square foot apartments. Both Dhaka and Chittagong, Bangladesh’s two major cities, have robust real estate markets. There is a high need for compact housing in Bangladesh’s bustling cities like Dhaka and Chittagong. The real estate industry in Bangladesh saw two distinct boom periods, the first from 2006 through 2009 and the second from 2015 to 2018. We could see another spike between the years 2022 and 2025. Generational shifts and shifts in popular culture, a lack of available land, and a revolution in affordable housing are all elements that will contribute to a new population boom. Over the past decade, Bangladesh has experienced tremendous growth in the number of designated residential zones around the nation. Every year the flats on demand reached a staggering 120,000 figure. Furthermore, around 42% of homes are now constructed by real estate companies in Dhaka.

The prices of apartments and land increased by a huge margin over the past few decades. The average land price followed an upward trajectory since 1975.

The average apartment prices in Dhaka also witnessed a significant margin of increase.

The rising cost of land and other building supplies have contributed to this trend. Rising land prices in Dhaka city are not being regulated by the government. Apartment prices are directly proportional to the cost of land. Also, the cost of building materials including bricks, granular sand, cement, rods, etc., skyrocketed after 2005. Because of these two issues, rental housing costs have risen.

One of the key factors in the growth and industrialization of a nation’s economy is the construction and sale of homes. The real estate market in Bangladesh is becoming a key part of our economy. It is a major contributor to economic expansion because of the significant multiplier effect it has on other economic activity. After agriculture, this industry is a major source of employment in the economy.

The real estate sector and its associated sectors such as steel, cement, tiles, sanitary ware, electric ware, paint, glass and aluminum, brick, building materials, and consumer durables, according to REHAB, contribute 12% to GDP. About Tk. 20 billion in transactions have been made, and about Tk. 2 billion per year is brought in as taxable income from the real estate sector. There are now over 2 million individuals working in the real estate sector and other businesses. This comprises both direct and indirect workers as well as architects and engineers. Over the previous five years, this sector’s enterprises have increased GDP by an average of 12-14% yearly.

Even with the economic recession and downward trend globally, the real estate market in Bangladesh incredibly shows amazing prospects for the future. The real estate industry is witnessing more and more investments and the government is also emphasizing its importance to attract sizable investments both locally and internationally. The following section will discuss some key trends in the future for this industry:

The government’s decision to let the investment of tax-free income into real estate was a major step in the right direction toward increasing real estate investment. As a result, about Tk 3,200 crores have been invested into the property market without incurring any tax liability. More money will be invested in such properties according to many experts in this field. Increased investment into the industry will also be the outcome of other crucial legislation, such as lowering house loan interest rates to 9% and decreasing land transfer taxes from 2% to 1% and stamp duty costs from 3% to 1.50%. Hence, the next five years look very promising for this industry.

Bangladesh is a relatively small country and people are more inclined to live in the city areas, especially the capital Dhaka. Hence, the population density is quite high in such regions. Due to the availability of high-standard amenities, the demand for apartments in Dhaka is rising. The year 2020 saw a dramatic rise in interest in the property despite the pandemic’s blows. Research shows that at year’s end, the land was in more demand than at any point during the year. That being said, there is a valid explanation. When opposed to investing in buildings, real estate’s low returns make buying land a far better option. Land on the outskirts of Dhaka, in areas like Purbachal, is more affordable than within the city itself. Land there is also rising rapidly in value. As a result, there has been an uptick in interest in purchasing property in Purbachal and neighboring locations. The real estate industry in Bangladesh is forecast to maintain its growth pattern through 2023 and so on. As the economy recovers from the pandemic’s impacts, more individuals will be able to afford to buy property, especially in Purbachal.

The real estate industry is crucial to the health of our country’s economy. Residential and commercial infrastructure development, vacant and underutilized land redevelopment, helping other businesses expand, attracting local and international investment, and creating jobs are all direct ways in which this sector contributes to GDP. Since its start, the real estate market has continued to expand steadily. It’s reasonable to assume that the country’s real estate industry is growing and diversifying in line with the country’s overall socioeconomic progress. The growth of the real estate industry in Bangladesh is a barometer of the country’s progress and a source of optimism for millions of Bangladeshis who now have a place to call home or a job they love. A prosperous future is ahead for this industry and our country if the current rate of market expansion is maintained. Finally, the overall situation of the real estate industry in Bangladesh shows promise for a better future ahead for everyone involved with this industry and for the general people who are looking to find an affordable and suitable home.

Ans: Residential, commercial, industrial, and land are the main categories of real estate.

Ans: The industry began its journey in the 1970s but it really took off in the 1980s.

Ans: Real estate contributes around 12% of the national GDP.

Ans: Almost 2 million people are directly or indirectly involved in this industry.